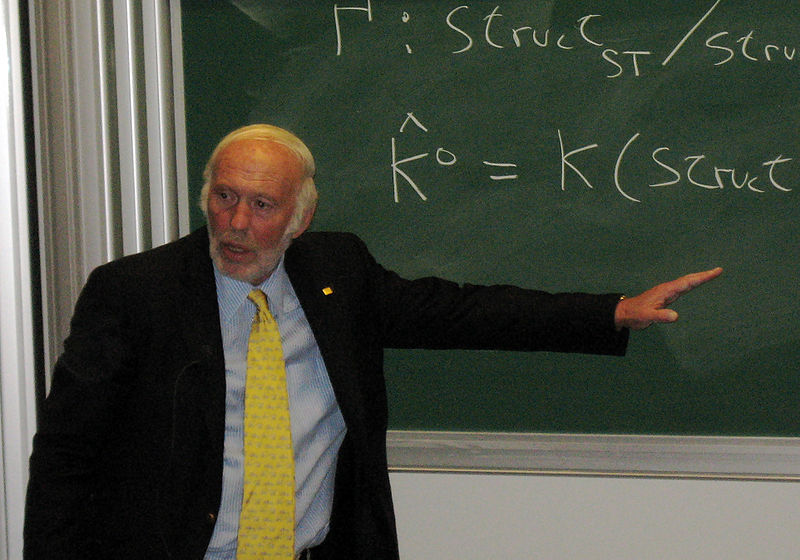

James Simons

James Harris "Jim" Simons (born 1938) is an American mathematician, hedge fund manager, and philanthropist. He is a code breaker and studies pattern recognition. Simons is the co-inventor, with Shiing-Shen Chern, of the Chern-Simons form - Chern and Simons (1974), and contributed to the development of string theory by providing a theoretical framework to combine geometry and topology with quantum field theory. Simons was a professor of mathematics at Stony Brook University and was also the former chair of the Mathematics Department at Stony Brook.

In 1982, Simons founded Renaissance Technologies, a private hedge fund investment company based in New York with over $25 billion under management. Simons retired at the end of 2009 as CEO of one of the world's most successful hedge fund companies. Simons' net worth is estimated to be $14 billion.

Simons lives with his wife Marilyn H. Simons in Manhattan and Long Island, and is the father of five children; two of his children died young under tragic circumstances—a drowning and an auto crash.

Simons shuns the limelight and rarely gives interviews, citing Benjamin the Donkey in Animal Farm for explanation: "God gave me a tail to keep off the flies. But I'd rather have had no tail and no flies." On October 10, 2009, Simons announced he would retire on January 1, 2010 but remain at Renaissance as nonexecutive chairman.

In 2016, asteroid 6618 Jimsimons, discovered by Clyde Tombaugh in 1936, was named after Simons by the International Astronomical Union in honor of his numerous contributions to mathematics and philanthropy.

Early life and education

James Harris Simons was born to a Jewish family, the only child of Marcia (née Kantor) and Matthew Simons, and raised in Brookline, Massachusetts. His father owned a shoe factory.

He received a Bachelor of Science in mathematics from the Massachusetts Institute of Technology in 1958 and a Ph.D., also in mathematics, from the University of California, Berkeley, under supervision of Bertram Kostant in 1961, at the age of 23.

Business career

| A Rare Interview with the Mathematician Who Cracked Wall Street, 23:03, TED Talks | |

| The Carnegie Medal of Philanthropy Ceremony - 17th October 2013, 1:31:40 (Simons section at 52:00-1:05:30), Scottish Parliament |

Renaissance Technologies

Main article: Renaissance TechnologiesFor more than two decades, Simons' Renaissance Technologies' hedge funds, which trade in markets around the world, have employed mathematical models to analyze and execute trades, many automated. Renaissance uses computer-based models to predict price changes in financial instruments. These models are based on analyzing as much data as can be gathered, then looking for non-random movements to make predictions.

Renaissance employs specialists with non-financial backgrounds, including mathematicians, physicists, signal processing experts and statisticians. The firm's latest fund is the Renaissance Institutional Equities Fund (RIEF). RIEF has historically trailed the firm's better-known Medallion fund, a separate fund that only contains the personal money of the firm's executives.

- "It's startling to see such a highly successful mathematician achieve success in another field," says Edward Witten, professor of physics at the Institute for Advanced Study in Princeton, NJ, and considered by many of his peers to be the most accomplished theoretical physicist alive... (Gregory Zuckerman, "Heard on the Street", Wall Street Journal, July 1, 2005).

In 2006, Simons was named Financial Engineer of the Year by the International Association of Financial Engineers. In 2007, he was estimated to have personally earned $2.8 billion, $1.7 billion in 2006, $1.5 billion in 2005, (the largest compensation among hedge fund managers that year) and $670 million in 2004.

Academic and scientific career

Simons' mathematical work has primarily focused on the geometry and topology of manifolds. His 1962 Berkeley PhD thesis, written under the direction of Bertram Kostant, gave a new and more conceptual proof of Berger's classification of the holonomy groups of Riemannian manifolds, which is now a cornerstone of modern geometry. He subsequently began to work with Shing-Shen Chern on the theory of characteristic classes, eventually discovering the Chern-Simons secondary characteristic classes of 3-manifolds, which are deeply related to the Yang-Mills functional on 4-manifolds, and have had a profound effect on modern physics. These and other contributions to geometry and topology led to Simons becoming the 1976 recipient of the AMS Oswald Veblen Prize in Geometry. In 2014, he was elected to the National Academy of Sciences of the USA.

In 1964, Simons worked with the National Security Agency to break codes. Between 1964 and 1968, he was on the research staff of the Communications Research Division of the Institute for Defense Analyses (IDA) and taught mathematics at the Massachusetts Institute of Technology and Harvard University, ultimately joining the faculty at Stony Brook University. In 1968, he was appointed chairman of the math department at Stony Brook University.

Simons was asked by IBM in 1973 to attack the block cipher Lucifer, an early but direct precursor to the Data Encryption Standard (DES).

Simons founded Math for America, a nonprofit organization, in January 2004 with a mission to improve mathematics education in United States public schools by recruiting more highly qualified teachers. He funds a variety of research projects.

Philanthropy

Simons and his second wife, Marilyn Hawrys Simons, co-founded the Simons Foundation in 1994, a charitable organization that supports projects related to education and health, in addition to scientific research. In memory of his son Paul, whom he had with his first wife, Barbara Simons, he established Avalon Park, a 130-acre (0.53 km2) nature preserve in Stony Brook. In 1996, 34-year-old Paul was killed by a car driver while riding a bicycle near the Simons home. Another son, Nick Simons, drowned at age 24 while on a trip to Bali in Indonesia in 2003. Nick had worked in Nepal. The Simons have become large donors to Nepalese healthcare through the Nick Simons Institute.

In 2004, Simons founded Math for America with an initial pledge of $25 million from the Simons Foundation, a pledge he later doubled in 2006.

Also in 2006, Simons donated $25 million to Stony Brook University through the Stony Brook Foundation, the largest donation ever to a State University of New York school.

On February 27, 2008, then Gov. Eliot Spitzer announced a $60 million donation by the Simons Foundation to found the Simons Center for Geometry and Physics at Stony Brook, the largest gift to a public university in New York state history.

In December 2008, it was reported that the Stony Brook University Foundation, of which Simons is chair emeritus, lost $5.4 million in Bernard Madoff’s Ponzi scheme.

Political contributions

Simons is a major contributor to Democratic Party political action committees. As of April 2016 he had contributed $7 million to a super PAC that backs Hillary Clinton's 2016 bid.

Boardroom appointments

Simons serves as trustee of Brookhaven National Laboratory, the Institute for Advanced Study, Rockefeller University, the Mathematical Sciences Research Institute in Berkeley and a trustee of Stony Brook University. He is also a member of the Board of the MIT Corporation.

Controversies

According to the Wall Street Journal in May 2009, Simons was questioned by investors on the dramatic performance gap of Renaissance Technologies' portfolios. The Medallion Fund, which has been available exclusively to current and past employees and their families surged 80% in 2008 in spite of hefty fees; the Renaissance Institutional Equities Fund (RIEF), owned by outsiders, lost money in both 2008 and 2009; RIEF declined 16% in 2008.

On July 22, 2014, Simons was subject to bipartisan condemnation by the U.S. Senate Permanent Subcommittee on Investigations for the use of complex barrier options to shield day-to-day trading (usually subject to higher ordinary income tax rates) as long-term capital gains. “Renaissance Technologies was able to avoid paying more than $6 billion in taxes by disguising its day-to-day stock trades as long term investments,” said Sen. John McCain (R., Ariz.), the committee’s ranking Republican, in his opening statement. “Two banks and a handful of hedge funds developed a complex financial structure to engage in highly profitable trades while claiming an unjustified lower tax rate and avoiding limits on trading with borrowed money,” said Sen. Carl Levin (D., Mich.) in his prepared remarks.

An article published in the New York Times claimed that James Simons was involved in one of the biggest tax battles of 2015.

Wealth

Simons earned an estimated $2.5 billion in 2008, and with an estimated net worth of $12.5 billion, he is ranked by Forbes as the 88th-richest person in the world and the 27th-richest person in America. He was named by the Financial Times in 2006 as "the world's smartest billionaire".

In 2011, he was included in the 50 Most Influential ranking of Bloomberg Markets Magazine.

Simons owns a motor yacht, named 'Archimedes'. It was built at the Dutch yacht builder Royal Van Lent and delivered to Simons in 2008.

Selected works

- "Minimal Cones, Plateau's Problem, and the Bernstein Conjecture". Proc Natl Acad Sci U S A 58 (2): 410-411. August 1967. doi:10.1073/pnas.58.2.410. PMC 335649. PMID 16578656.

- with Shiing-Shen Chern: "Some Cohomology Classes in Principal Fiber Bundles and Their Application to Riemannian Geometry". Proc Natl Acad Sci U S A 68 (4): 791-794. April 1971. doi:10.1073/pnas.68.4.791. PMC 389044. PMID 16591916.

- with Jean-Pierre Bourguignon and H. Blaine Lawson: "Stability and gap phenomena for Yang-Mills fields". Proc Natl Acad Sci U S A 76 (4): 1550-1553. April 1979. doi:10.1073/pnas.76.4.1550. PMC 383426. PMID 16592637.

- "Minimal varieties in riemannian manifolds". Annals of Mathematics 88 (1): 62-105. July 1968. doi:10.2307/1970556.

- with Shiing-Shen Chern: "Characteristic forms and geometric invariants". Annals of Mathematics 99 (1): 48-69. January 1974. doi:10.2307/1971013.

[ Source: Wikipedia ]